Tax Parcel Data Management Solution Released

Property taxes are the largest source of revenue in most local governments. Seventy percent (70%), or more, of the local government budget, may come from property taxes that have been derived from the property valuation process. In most cases, the local government has a statutory responsibility to maintain legal records affecting ownership, title, the basis of revenue (taxes, recording fees), and equalization for the value of assessments based on land and property values.

According to the Federal Reserve, the median sales price of houses sold – has increased ~32% from 2020 to 2023. This increase in property value correlates to higher property assessments, which has put assessors in the spotlight. A sudden increase in property taxes can be a tough pill to swallow for many homeowners. Ensuring that their tax parcel repository is accurate and continuously improving can be challenging and time-consuming for many organizations. Assessment decisions need to be equitable and supported by robust and accurate data. Especially when presented with increased appeals and scrutiny.

The Tax Parcel Data Management solution delivers a set of capabilities that help local governments inventory tax parcels from record information and share this information with internal and external stakeholders.

Streamline tax parcel data management.

Mapping technicians and plant engineers need to enter paper records into GIS to create a digital representation and reference to the physical location of boundary information of tax parcels, subdivisions, lots, and condominiums.

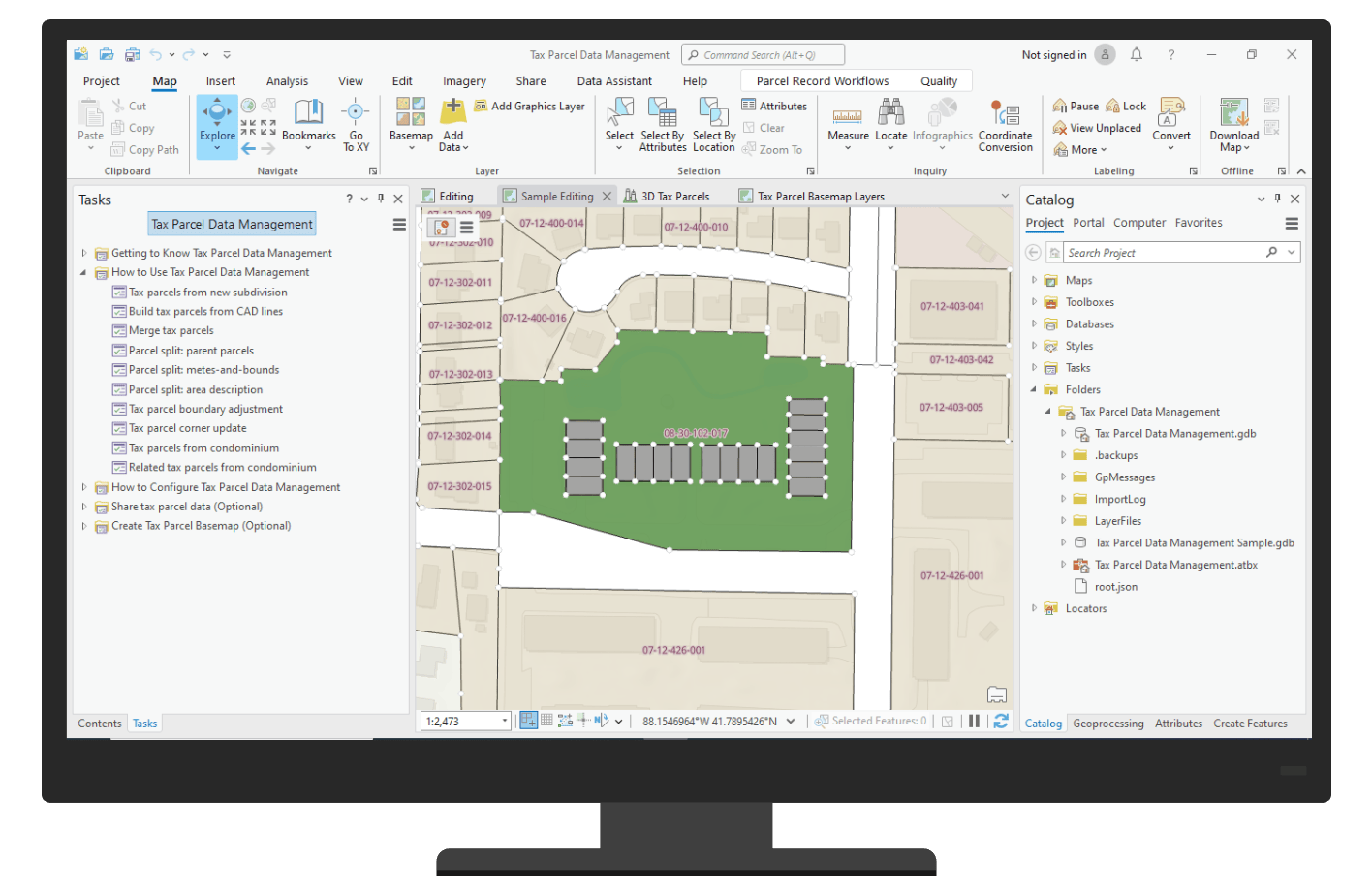

The solution provides an ArcGIS Pro project with a structured set of tasks that reduce the time it takes to enter plans and data, as well as share tax parcel information. There is a configurable data model which ships with the solution, as well as sample data to test workflows and see the tasks in action.

Improve interagency collaboration

As the inventory of tax parcels is developed and maintained, this data can be shared with both internal and external stakeholders. The resulting data can be shared with your ArcGIS Online organization.

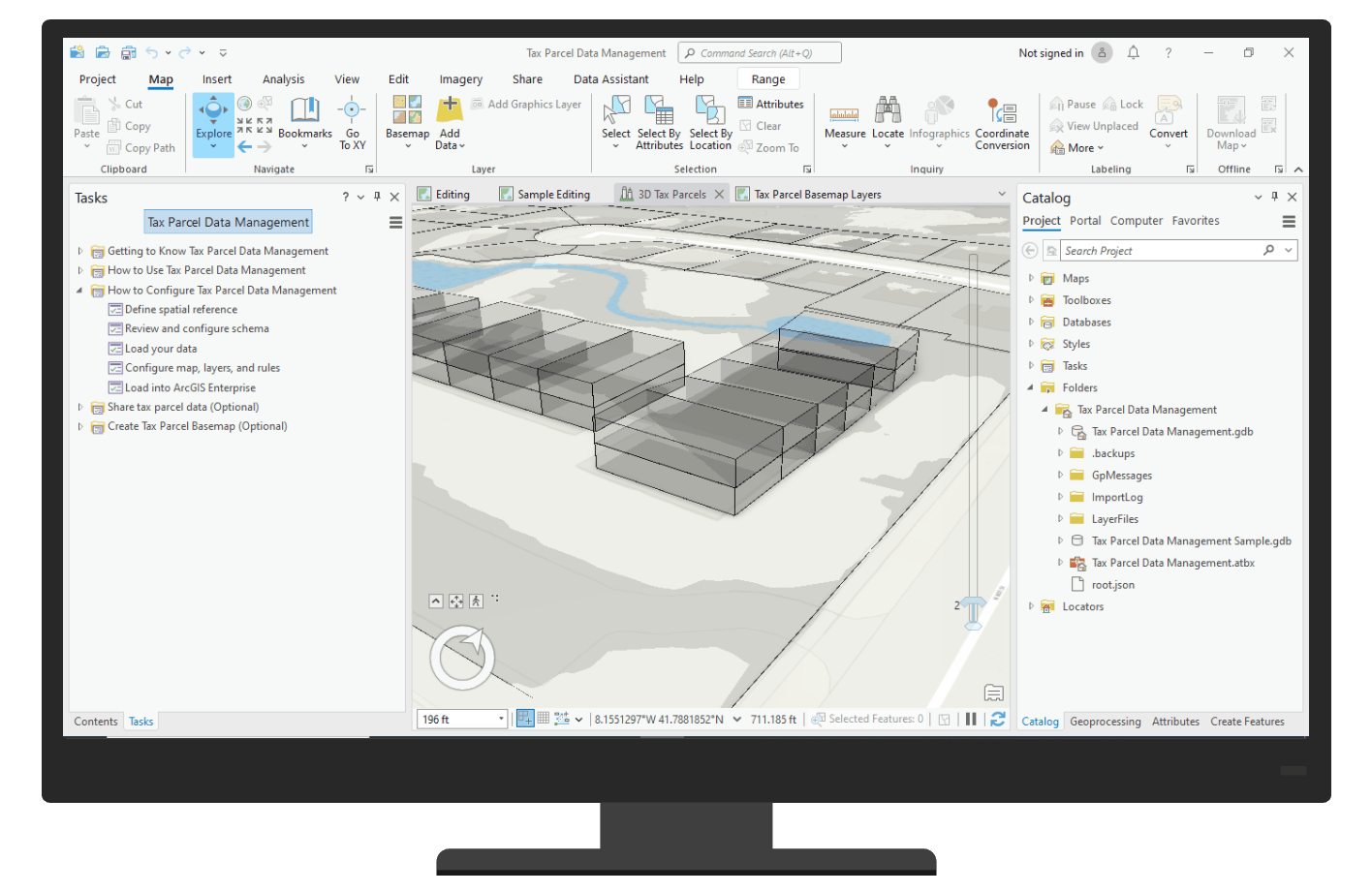

By leveraging the Parcel Fabric‘s floor-aware capability, the solution provides tools to help manage and visualize parcel information in 3D.

Additional Resources

We’re so happy to share this release with you. Below you can find additional resources you may find useful.

Watch the Tax Parcel Data Management video to learn more

Deploy Tax Parcel Data Management solution

Learn how to configure and use Tax Parcel Data Management

For questions and feedback, chat with us on Esri Community or contact Esri Support Services